Travelling nurses has actually more legwork when trying to get home financing, in lieu of people with a secure 9 to help you 5 business and you may foreseeable income. Here are some time-looked at insights getting a seamless homeowning journey.

Keep an enthusiastic immaculate paper path – Help save a duplicate of the many your travel breastfeeding agreements, shell out stubs, put slides, and related documents. You’ll need the new paperwork since proof of money and you can employment records. You can search and save yourself them on the web having fun with a cloud services such as for instance Dropbox.

Pick travel nursing assistant assignments with a high nonexempt spend – Very loan providers often readily think about your app for those who have good high nonexempt money. You ount in the event that non-taxed make up most of your paycheck since you’ll have a great low base shell out. it may curb your credit options to a tiny category regarding lenders.

Polish the income tax studies – Travelling nurses located non-taxable stipends to help with living expenses and you will holiday accommodation as they take a trip for functions. The latest Irs does not income tax instance allowances since they’re duplicate expenses. Take a trip nurses wanted temporary household while on task as personal loans for bad credit Montana well as in their number 1 home. Explore Internal revenue service Book 463 to help you shine your income tax education and steer clear of legal trouble.

- Look after income tax family – Travel nurses have to maintain a taxation the home of be eligible for non-nonexempt stipends. Generally speaking, keeping a tax household provides around three standards, however, take a trip nurses just need one or two.

An informed Financial getting Travelling Nurses

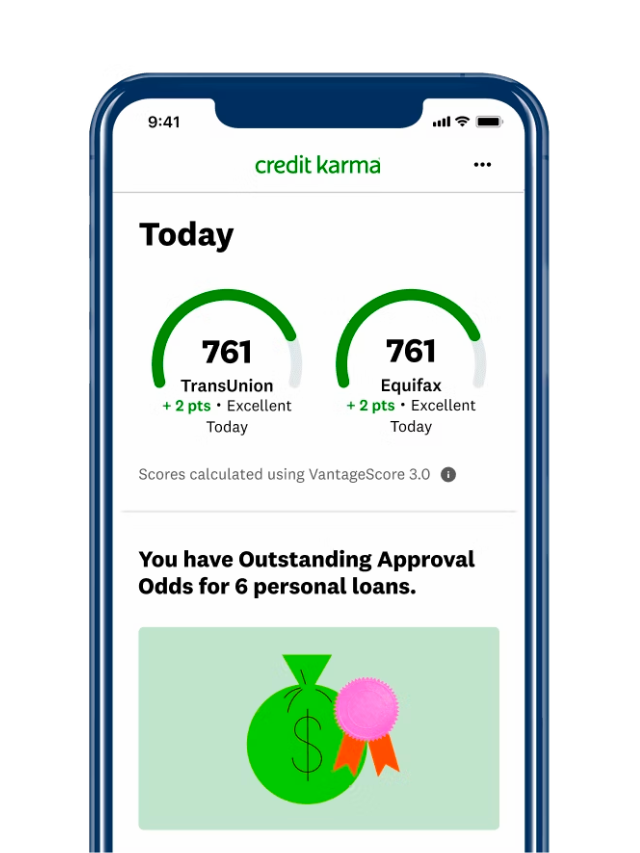

The best mortgage having a trips nurse utilizes your unique finances. Your capability to meet up with a beneficial lender’s first standards credit score, money top, debt-to-earnings ratio, an such like. identifies eligibility.

Unique Property Program having Nurses

Unfortunately, there are not any regulators-paid software to help nurses discover their dreams of running an effective house. Of many communities claim to let nurses or any other advantages get a great home, but just a small number of them are legitimate.

Internet sites such and you can claim to assist nurses pick property, but they normally have ulterior motives. Of numerous programs state they assistance with closure charges and you will off costs, but they’re not approved to incorporate such recommendations.

Antique Home loan to own Traveling Nurses

Called conforming loans, antique home loans have a premier cutoff area. Local and you will national loan providers give this type of financing following statutes conceived because of the Freddie Mac and Federal national mortgage association. You want a credit history with a minimum of 740 in order to safer a terms and conditions, nevertheless cutoff is about 620.

You need no less than 3% down seriously to be considered, but some thing below 20% causes individual mortgage insurance policies. Conforming finance are perfect for those with excellent credit scores and you may a considerable down-payment.

FHA Fund to own Take a trip Nurses

Quick to own a national Construction Administration mortgage, government entities backs an enthusiastic FHA financing. He’s quicker stringent requirements and are versatile on a career transform, credit scores, a career openings, and off costs.

You’ll need a great step 3.5% so you can ten% household deposit so you can be eligible for a keen FHA loan, so it is a chance-to selection for take a trip nurses who are unable to safer traditional financing.

USDA Loans getting Take a trip Nurses

Given by the U.S. Company out-of Agriculture under the USDA Outlying Development system, so it mortgage system goals rural residents. It is the really flexible government-recognized home loan system and requires zero downpayment.

Yet not, USDA loans carry area and you will earnings limitations. You can only use the home financing buying a home in the an eligible rural area, as well as your money can not be 15% along the regional average earnings.

Virtual assistant Money to own Travelling Nurses

When you are a vacation nursing assistant which have a background during the military characteristics, you might choose for a beneficial Va financing. The applying was backed by the new Service away from Veteran Points and was open to energetic services people, experts, and you will surviving spouses out-of experts but possess strict qualifying standards.